Blog

If the recent "Cabinet Files" of secret, government documents being sold through a second hand store have taught us anything, it's that sensitive documents can be sold both cheaply and easily, even when no there are no nefarious motives involved. New data breach rules in effect from 22 February 2018 place an increased onus on business to both protect and notify individuals whose personal information is involved in a data breach that is likely to result in serious harm.

As you are probably aware, company tax rates from 2017 financial year (FY) onwards have changed and there are implications for franking rates as a result. To ensure that you consider these changes and the effect that they may have on your business, we thought that we would bring you further clarification.

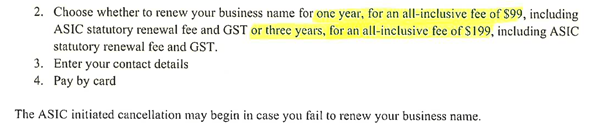

Recently, one of our clients notified us about a letter they had received from a business agency, regarding renewal of their business name. It was from a legitimate company and it referenced ASIC several times. It contained the following renewal and fee information:

Please note that you do not need to use an external agent (or your accountant) to renew your business name. It is now a simple matter of going directly to the ASIC website and completing the online details. The ASIC fee is $35 a year or a discounted fee of $82 for three years.

Of course, if you would like to discuss your renewal or would like us to do it for you, then please give us a call on 4861 8383 and we can discuss your options and any associated fees.

In Australia, Workers' Compensation is a necessary cost of employing staff, whether full-time, part-time or casual. Although the schemes in different states can vary slightly, many of the fundamentals remain the same. One such fundamental, is the declaration of wages that is required in order to gain an appropriate workers' compensation insurance policy for your business.

Legislation is expected to pass soon in parliament that will make it easier for many businesses to qualify for the small business concessions that were previously only available to those with an aggregated turnover below $2m.

Imagine the following....

"Hello, Mr Banker, we're out of cash again…"

When we hear the words "Fringe Benefits", many of us think only of motor vehicles, or as the festive season approaches, about the tax implications of the Office Christmas party. However, fringe benefits extend to many more areas, and probably ones you've never considered. As 2016 ends, and you start to wind down and think about celebrating, it might be worth considering the other fringe benefits you may be providing, and planning for the reporting requirements necessary for 31 March 2017.

Do you have employees with excessive accrued annual leave?